Before Estate Planning Was Part of Your Portfolio

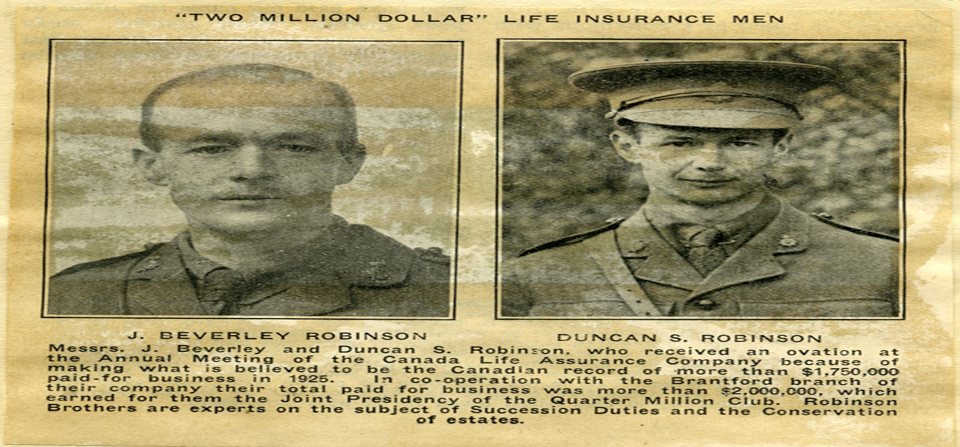

My grandfather and my great uncle, Duncan and Beverley Robinson, were the most successful life agents in Canada Life during the 1920s. This was well before estate planning had a definition or much of an understanding of what you could do today to protect your assets for the next generation.

Starting out in the same company, the Robinson Brothers (as they were referred to) knew little about insurance. To make up for this, they did an exhaustive study of the different types of income and business insurance. They coined the term estate conservation which later came to be known as estate planning.

Consultants in Estate Planning During the Roaring Twenties

Duncan and Beverley Robinson developed a unique service in their day. They helped people analyze their wealth and administer their estate by showing their clients the many uses for life insurance.

They prefaced that the task of estate planning was not simple, but one of vital importance for it required, in their words:

- Assembling all information concerning a client’s affairs;

- Analyzing the client’s situation to disclose any weaknesses, defects or pitfalls to which he, his family or his business may be exposed;

- Creating a plan to solve the problems;

- Tying together all segments into a unified whole; and Cooperating closely with the client’s attorney, accountant and trust officer in completing the plan.

- Practical Solutions Minimize Taxation & Create Wealth

The same principles hold true today and this is what I carry on at Freedom 55 Financial as I help my clients plan for tomorrow. As a financial advisor, I offer my clients suggestions in their financial planning and empower them with information so it will benefit them, their families and their beneficiaries.

With personal and business insurance suited to your situation, you can generate wealth and peace of mind. You can even leave a legacy that will benefit others generations into the future.